Let’s be real, managing money can be a drag. Between bills, groceries, and the occasional impulse buy, it’s easy to lose track of where your hard-earned cash goes. But guess what? It doesn’t have to be a constant struggle.

With the right budgeting app, you can say goodbye to financial stress and hello to smart spending habits. We’ve rounded up five of the best budgeting apps out there, all designed to help you take control of your finances and achieve your money goals. Ready to dive in?

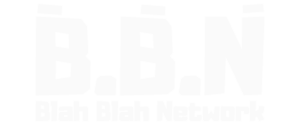

1. Mint: The Budgeting All-Rounder

Mint is like the superhero of budgeting apps – powerful, popular, and always ready to save the day (or at least your finances). Owned by Intuit (the same folks behind TurboTax), Mint seamlessly connects to your bank accounts, credit cards, and investments, giving you a complete picture of your financial life in one place.

Pros:

- Automatic Syncing: Mint automatically updates and categorizes your transactions, so you don’t have to waste time manually inputting every coffee purchase.

- Personalized Insights: Forget generic advice. Mint analyzes your spending habits and provides personalized tips and recommendations tailored to your unique financial situation.

- Goal Setting: Saving for a dream vacation or finally tackling that student loan debt? Mint helps you set realistic financial goals and tracks your progress every step of the way.

- Free to Use: Yes, you read that right. Mint’s core features are completely free, making it an accessible choice for budgeters on a tight budget.

Cons:

- Occasional Syncing Issues: While generally reliable, Mint can sometimes experience syncing glitches with certain financial institutions.

- Limited Investment Tracking: While Mint provides a basic overview of your investments, it might not be robust enough for serious investors seeking in-depth portfolio analysis.

Get Mint: mint.intuit.com

User Review:

“Mint has been a game-changer for my finances. It’s helped me finally understand where my money is going and identify areas where I can cut back. Plus, it’s free! Can’t beat that.” – Sarah J. (Trustpilot)

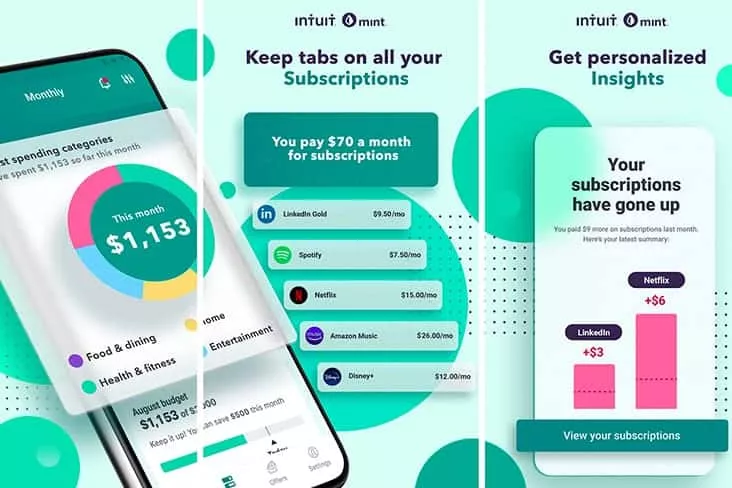

2. YNAB (You Need A Budget): The Zero-Based Budgeting Guru

YNAB takes a proactive approach to budgeting with its famous “zero-based budgeting” method. This means you assign every single dollar a job, ensuring that your income minus your expenses equals zero by the end of the month.

Pros:

- Focus on Prioritization: YNAB empowers you to make conscious spending decisions by forcing you to prioritize your needs and wants each month.

- Forward-Looking Planning: Instead of just tracking past spending, YNAB encourages you to anticipate upcoming expenses and adjust your budget accordingly.

- Debt Snowball Tool: Struggling with debt? YNAB’s built-in debt snowball feature helps you pay down debt faster by focusing on the smallest balances first.

- Supportive Community: YNAB has a vibrant online community where you can connect with fellow budgeters, share tips, and get support along your financial journey.

Cons:

- Subscription-Based: Unlike Mint, YNAB requires a paid subscription. However, many users find the investment worthwhile due to the app’s effectiveness.

- Steeper Learning Curve: YNAB’s unique methodology might take some time to grasp, especially for budgeting beginners.

Get YNAB: www.ynab.com

User Review:

“YNAB has been life-changing for me. I used to be terrible with money, but now I feel in control of my finances for the first time ever. It’s worth every penny.” – Mark S. (Apple App Store)

3. Personal Capital: The Investment Savvy Choice

Personal Capital combines budgeting tools with robust investment tracking and analysis features, making it an excellent choice for those looking to grow their wealth.

Pros:

- Comprehensive Investment Tracking: Track all your investments in one place, including 401(k)s, IRAs, and taxable accounts.

- Fee Analyzer: Uncover hidden investment fees that are eating into your returns. Personal Capital’s fee analyzer identifies and quantifies these fees, potentially saving you thousands over time.

- Retirement Planner: Plan for a comfortable retirement with Personal Capital’s interactive retirement planner. Adjust your savings goals and see the impact on your retirement projections.

- Financial Advisor Access: For an additional fee, you can access certified financial advisors who can provide personalized guidance and investment management services.

Cons:

- Not Ideal for Basic Budgeting: While Personal Capital offers budgeting tools, its primary focus is investment management. If you’re seeking a more comprehensive budgeting solution, Mint or YNAB might be better choices.

- Free Version Limitations: Some advanced features, such as the Retirement Fee Analyzer and personalized advice from a financial advisor, require a paid subscription.

Get Personal Capital: www.empower.com

User Review:

“Personal Capital has made managing my investments a breeze. The fee analyzer alone has saved me a ton of money. Highly recommend it.” – David L. (Google Play Store)

4. PocketGuard: The Set-It-and-Forget-It Budgeter

PocketGuard takes the hassle out of budgeting by automating much of the process. Simply link your accounts, and the app analyzes your income, expenses, and savings goals to determine your “In My Pocket” allowance – the amount you have available to spend each day.

Pros:

- Simplicity and Ease of Use: PocketGuard’s intuitive interface and straightforward approach make it incredibly user-friendly, especially for budgeting newbies.

- Automated Savings: Set a savings goal, and PocketGuard automatically transfers funds from your checking account to your savings account on a regular basis.

- Bill Negotiation Feature: PocketGuard can negotiate lower bills on your behalf for services like cable, internet, and insurance.

- Free Version Available: PocketGuard’s basic features are free to use, with the option to upgrade for access to premium features like extended transaction history and cash flow analysis.

Cons:

- Limited Customization: PocketGuard’s automated approach might not be suitable for users who prefer a more hands-on budgeting experience with detailed expense tracking.

- Reliance on Accurate Data: The accuracy of PocketGuard’s recommendations depends on the accuracy of your financial data. Ensure your linked accounts are up-to-date to maximize the app’s effectiveness.

Get PocketGuard: pocketguard.com

User Review:

“I love PocketGuard’s simplicity. It tells me exactly how much I can spend each day, which keeps me from overspending. It’s like having a personal finance assistant in my pocket.” – Emily K. (Trustpilot)

5. Goodbudget: The Envelope System Goes Digital

Goodbudget brings the classic “envelope system” of budgeting into the digital age. With this method, you allocate specific amounts of money to different spending categories (like groceries, entertainment, and transportation) just as if you were dividing cash into physical envelopes.

Pros:

- Visual and Tangible Approach: The envelope system is a great option for visual learners who benefit from seeing how much money they have allocated to each category.

- Shared Budgeting: Goodbudget allows you to share your budget with a partner or family member, making it easy to stay on the same page financially.

- Debt Tracking: Goodbudget includes a debt tracking feature that helps you stay motivated and on track with your debt repayment goals.

- Free and Paid Versions: Goodbudget offers a free version with limited envelopes and devices. Upgrading to a paid plan unlocks unlimited envelopes, devices, and access to historical data.

Cons:

- Manual Entry Required: Goodbudget doesn’t offer automatic transaction syncing, so you’ll need to manually enter your transactions or import them from your bank.

- Limited Reporting and Analysis: While Goodbudget provides a clear overview of your budget, it lacks the robust reporting and analysis features offered by some other apps like Mint or Personal Capital.

Get Goodbudget: goodbudget.com

User Review:

“Goodbudget is the only budgeting app I’ve been able to stick with. The envelope system just makes sense to me, and I love that I can share my budget with my spouse.” – Chris B. (Apple App Store)

Choosing the Right App for You

The best budgeting app for you depends on your individual needs, preferences, and financial goals. Consider what matters most to you.

- Do you want an app that automatically syncs your transactions? Choose Mint, PocketGuard, or Personal Capital.

- Are you committed to the zero-based budgeting method? YNAB is your go-to.

- Seeking comprehensive investment tracking and analysis? Go with Personal Capital.

- Prefer a simple and automated budgeting experience? PocketGuard might be a good fit.

- Drawn to the envelope system of budgeting? Give Goodbudget a try.

Remember, the key to successful budgeting is finding a system that works for you and sticking with it. Experiment with a few different apps to discover the one that fits your financial style and helps you achieve your money goals.